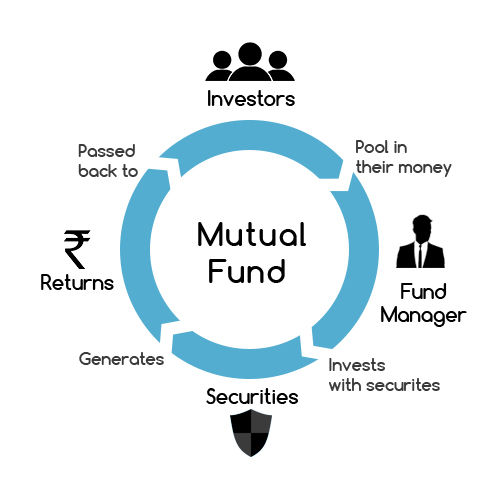

A mutual fund is a way for people to invest their money together. Imagine a large pool where many people put in different amounts of money. This pool of money is then used to buy different investments, like stocks, bonds, or other financial assets. A team of experts, known as fund managers, makes these buying and selling decisions, aiming to grow the pool over time.

How Does It Work?

- Pooling Money Together: When you invest in a mutual fund, you add your money to this large pool along with other investors.

- Professional Management: The fund manager decides where to invest the pooled money based on research and analysis.

- Diversification: Instead of buying just one type of asset, a mutual fund invests in a variety of assets, spreading the risk.

- Easy Access: You can invest with a small amount, making it accessible for anyone who wants to grow their savings without needing deep investment knowledge.

Why Choose a Mutual Fund?

Mutual funds offer a convenient way to invest without having to research individual stocks or manage risks alone. They provide the benefit of expert management and give even small investors access to a wide range of investments, helping them build wealth over time.

<!-- wp:social-links --><ul class="wp-block-social-links"><!-- wp:social-link {"url":"https://gravatar.com/santushtisec","service":"gravatar","rel":"me"} /--></ul><!-- /wp:social-links -->