Understanding the Difference Between Absolute Return and XIRR in Investment Analysis

In investment analysis, two common metrics are often used to evaluate returns: Absolute Return and XIRR (Extended Internal Rate of Return). Both metrics serve specific purposes and provide distinct insights into investment performance. Here’s a breakdown of each and when to use them.

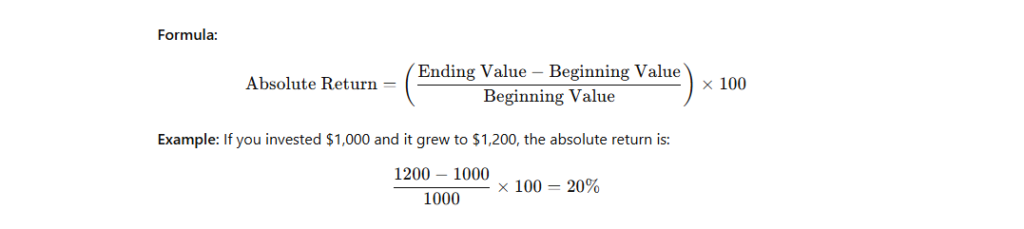

1. What is Absolute Return?

Absolute Return refers to the total increase or decrease in an investment’s value over a given period, without considering the time frame. It is usually expressed as a percentage and is a straightforward calculation:

Pros of Absolute Return:

- Simple to calculate and understand.

- Useful for comparing short-term or specific investment gains over a set period.

Cons of Absolute Return:

- Ignores the time factor, making it less useful for comparing investments held over different time periods.

2. What is XIRR?

XIRR stands for Extended Internal Rate of Return. Unlike absolute return, XIRR considers the time value of money and cash flow timing (such as multiple investments or redemptions over time). XIRR is essentially an annualized return calculation that can handle irregular cash flows, making it ideal for investments with non-uniform inflows and outflows.

Formula: The XIRR calculation is complex and typically requires a financial calculator or spreadsheet software, like Excel, where the XIRR function is available. XIRR works by solving for the discount rate that sets the net present value of cash flows to zero, assuming cash flows at irregular intervals.

Pros of XIRR:

- Ideal for evaluating investments with multiple cash flows (e.g., SIPs, mutual funds).

- Provides an annualized rate of return, making it suitable for comparing across investments over varying timeframes.

Cons of XIRR:

- More complex to calculate.

- Requires accurate cash flow data, making it less practical for simpler, one-time investments.

When to Use Absolute Return vs. XIRR

- Absolute Return is suitable for short-term investments with no intermediate cash flows.

- XIRR is preferred for investments with multiple inflows/outflows over time and when you need to evaluate the compounded annual return.

Conclusion

Both Absolute Return and XIRR are valuable tools in an investor’s arsenal. Absolute Return is simple and effective for static investments, while XIRR gives a more nuanced picture for investments with irregular cash flows and over varying periods. Selecting the right metric depends on your investment strategy and the specifics of your investment flows.